cryptocurrency tax calculator uk

The original software debuted in 2014. CryptoTaxCalculator performs tax calculations with a high degree of accuracy carefully considering complex tax scenarios such as DeFi loans DEX transactions gas fees leveraged trading and staking rewards.

Wade S Cryptocurrency Trading Journal Tax Calculator Spreadsheet Amazon Co Uk Software

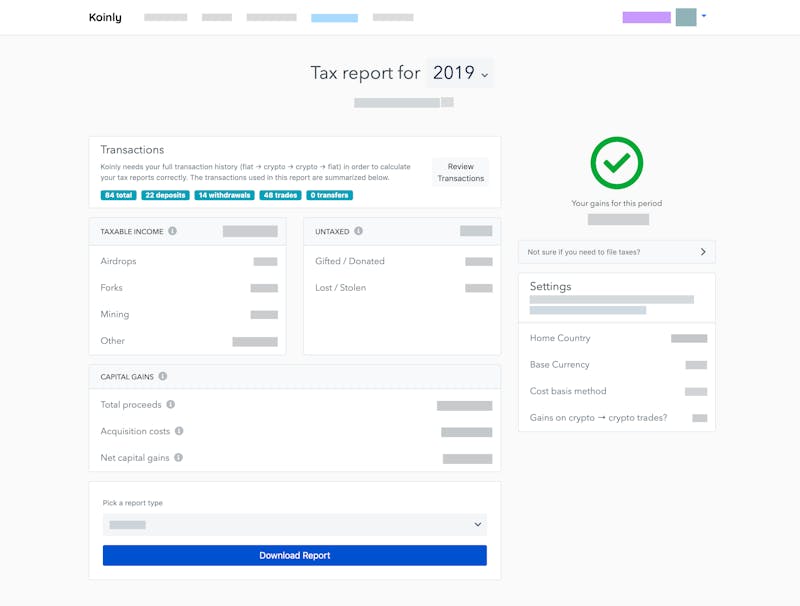

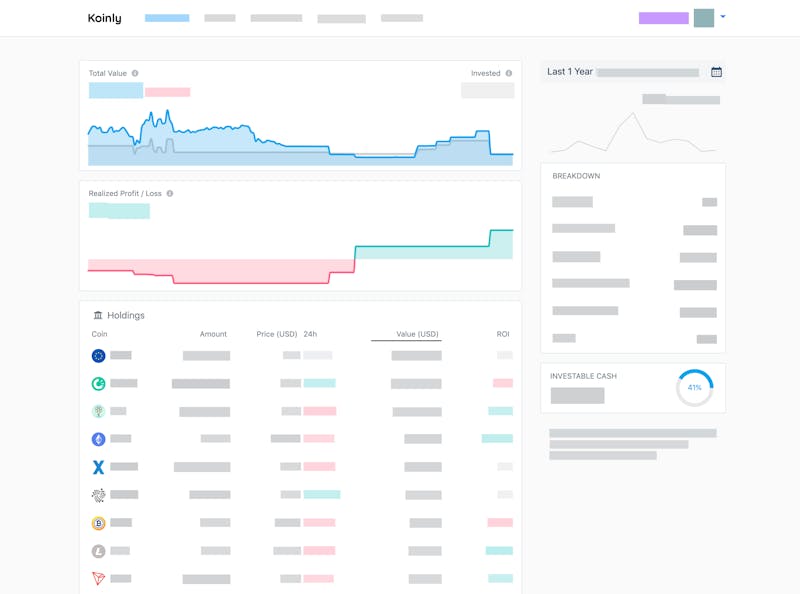

The platform is also to start using Koinlys crypto tax calculator.

. All coins previously acquired. Your business is back by cryptocurrency ie. HMRC also suggests what cost you can deduct from disposal proceeds to calculate capital gain.

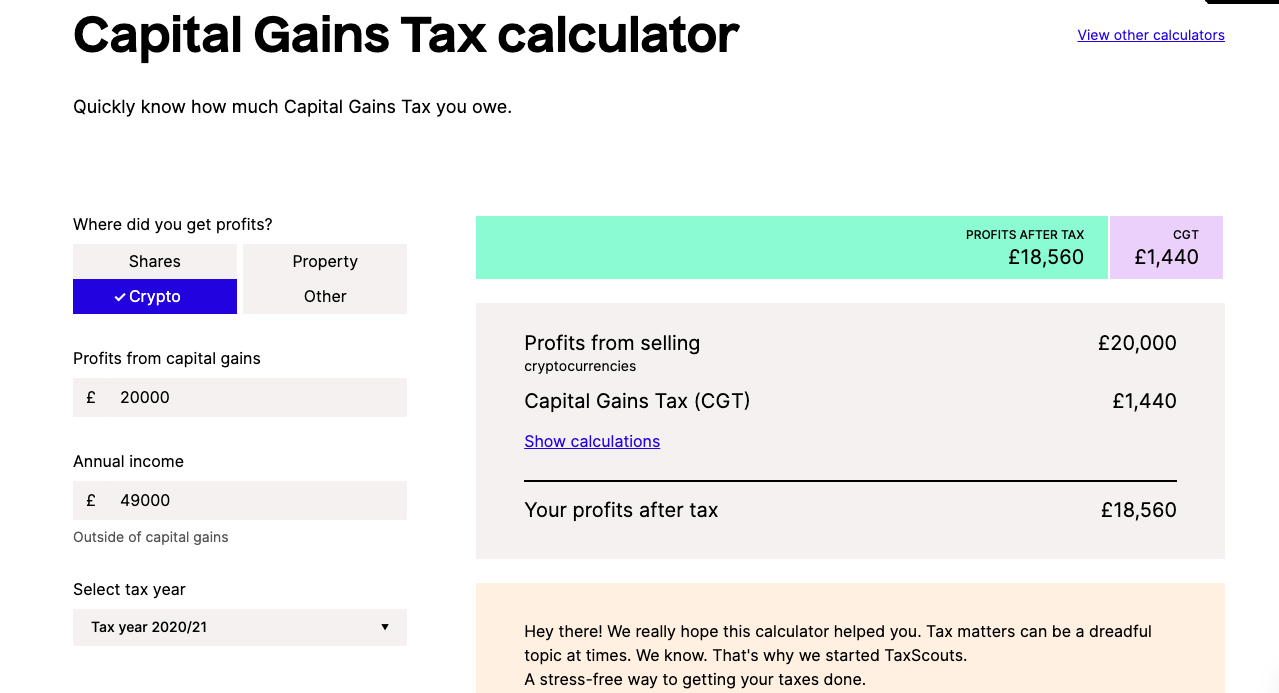

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Simple accurate and trusted. Subtract your Capital Gains Tax Allowance 12300 from your total taxable gains.

You trade with crypto instead of fiat In this case youll also be liable to pay Income Tax and National Insurance. Coins acquired within 30 days of the sale disposal 3 Total pool. Since then its developers have been creating native apps for mobile devices and other upgrades.

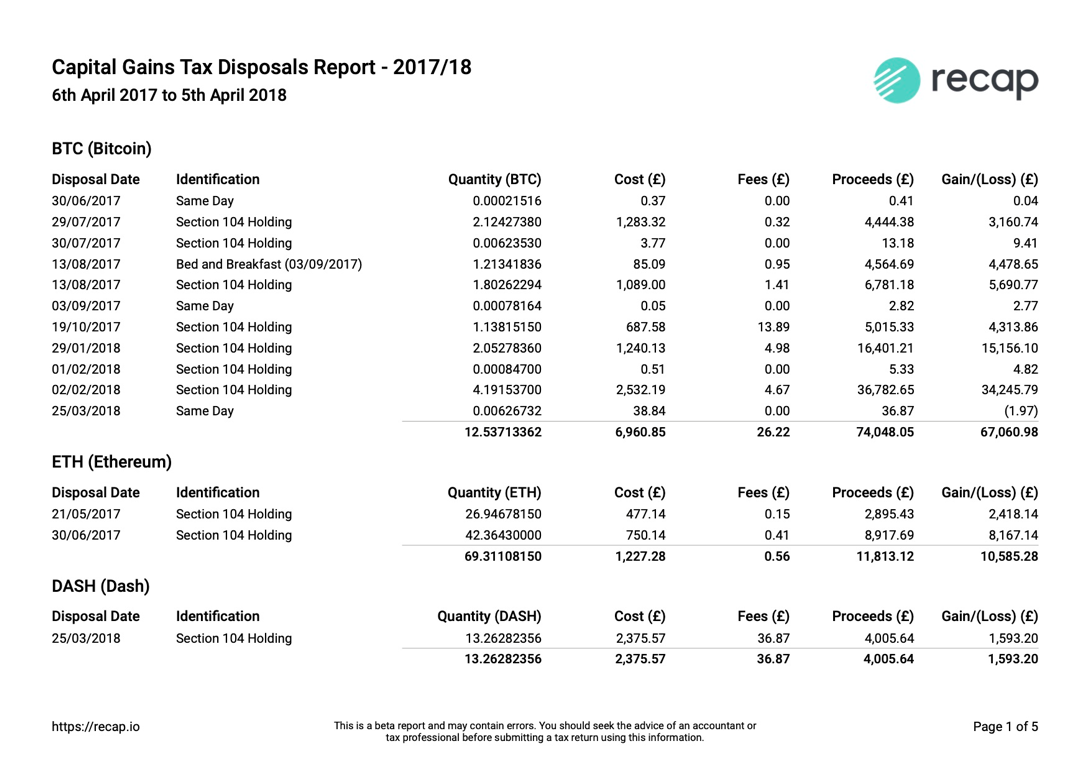

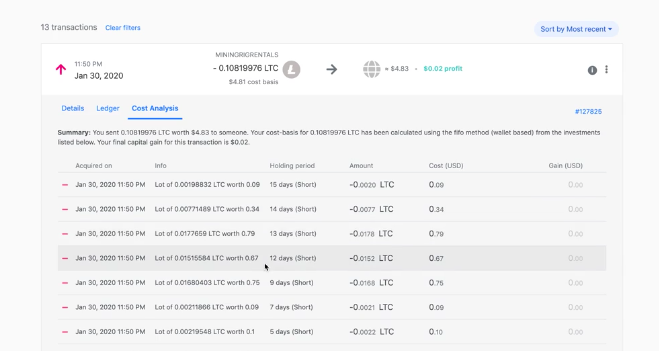

Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. When you spend sell or trade a cryptocurrency you need to calculate the capital gains by disposing the coins in the following order. Latest news and advice on cryptocurrency taxes.

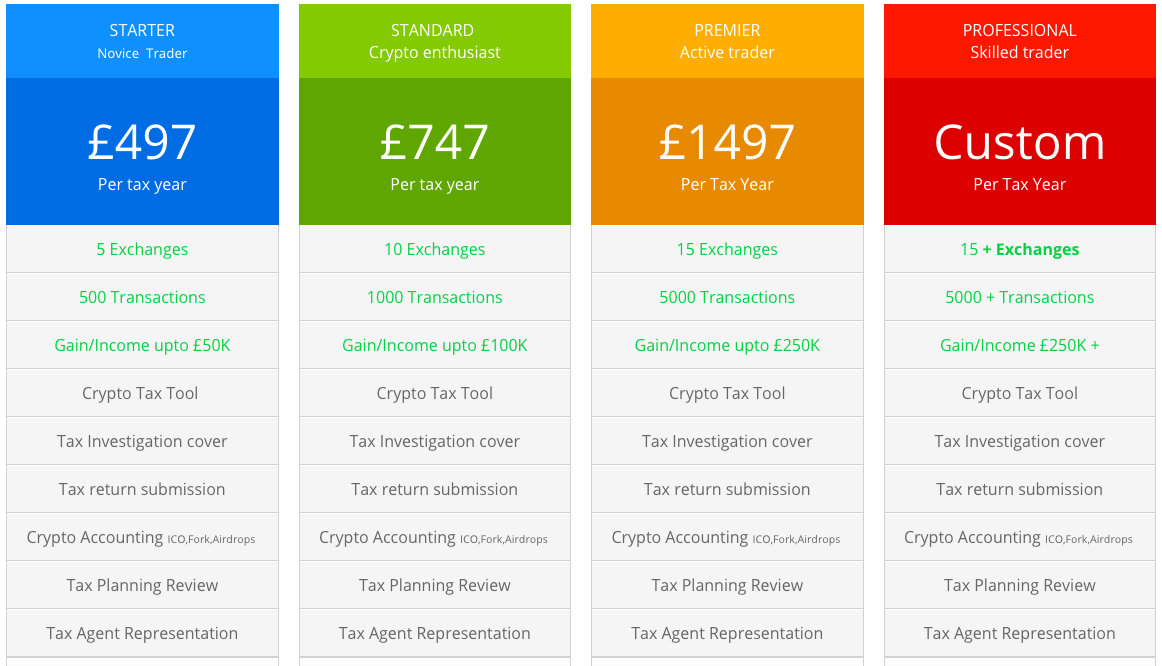

We can help every step of the way from discussing your needs to registering you and then completion of your cryptocurrency tax return to calculate any capital gains or income tax due. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. If this is in the higher rate or additional rate tax band youll pay 20 on your capital gains from crypto.

IRS Added a Question on Crypto Usage to Income Tax Form. Start for free pay only when you are ready to generate your. 12570 Personal Income Tax Allowance.

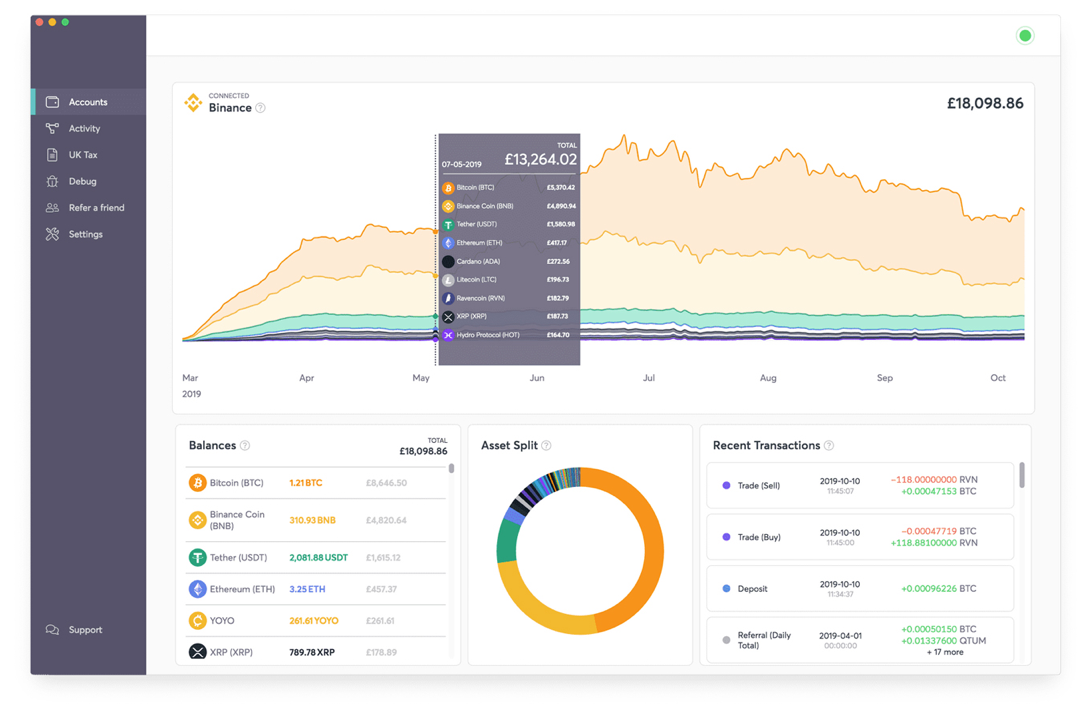

CoinTrackinginfo - the most popular crypto tax calculator. Heres an example of how to calculate the cost basis of your cryptocurrency. Easily calculate your cryptocurrency taxes.

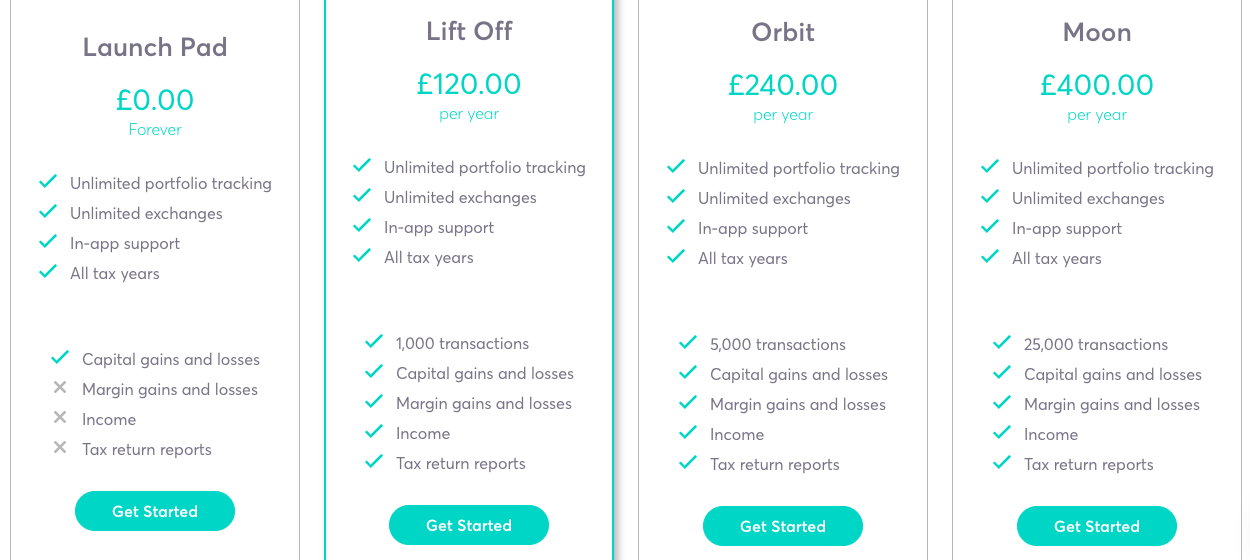

CryptoTaxCalculator is designed to support the unique HMRC reporting requirements including UK-specific Same Day and Bed Breakfast. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. In your case where your capital gains from shares were 20000 and your total annual earnings were 69000.

It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. That means you calculate your capital gains and if the result is below the limit you dont need to. Take the initial investment amount lets assume it is 1000.

Users can get tax preparations advice from tax attorneys CPAs and enrolled agents and planning with a tax expert to complete and file their returns. Crypto tax breaks. ZenLedger is a crypto tax software that supports integration with more than 400 exchanges including 30 Defi Protocols.

HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep. Bitcointax has been available since the 2019 tax year and offers a complete tax preparation service to UK customers. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

Coinpanda lets British citizens calculate their capital gains with ease. Then youll need to specify the buy and sell date of your assets. Offset your crypto.

Your first 12570 of income in the UK is tax free for the 20212022 tax year. Koinly helps UK citizens calculate their crypto capital gains. How to calculate your uk crypto tax calculating cryptocurrency in the uk is fairly difficult due to the unique rules around accounting for capital gains set out by the hmrc.

If this is within the basic income tax band youll pay 10 on your capital gains from crypto. You pay 1286 at 20 tax rate on the remaining 6430 of your capital. Coins bought on the same day as the sale disposal 2 30-day rule.

In our Guide To Tax on Cryptocurrency UK well explain the tax rules around cryptocurrency trading as a business. Generate ready-to-file tax forms including tax reports for Forks Mining Staking. UK crypto investors can pay less tax on crypto by making the most of tax breaks.

To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. UK citizens have to report their capital gains from cryptocurrencies. That means you calculate your capital gains and if the result is below the limit you dont need to pay any capital gains tax.

Learn how cryptocurrencies are taxed in your country. Allowances for tax-free capital gains in the UK by year source Cryptocurrency gifts to your spouse are also non-taxed and can effectively allow you to double your tax-free allowance in a given tax year. Youll need to separate all your transactions into capital gains transactions and income transactions.

We dont accept any new clients for 2021 tax season see you next year. Uses your cryptocurrency transaction history to generate a Schedule easily. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

Gifts to charity are also tax-free details. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. Uk crypto tax calculator with support for over 100 exchanges.

If you trade volumes that amount to what HMRC considers as financial trade youll also be liable to pay Income Tax although these cases are few and far between. The resulting number is your cost basis 10000 1000 10. Detailed case studies tutorials.

Learn how to calculate and file your taxes if you live in the United Kingdom. With more than 15K customers this crypto tax calculating application simplifies crypto tax to investors and tax professionals. For companies profits or losses from cryptocurrency trading are part of the trading profit rather than a chargeable gain.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. How to calculate crypto taxes in the UK. UK Cryptocurrency tax calculation and submission to HMRC.

Finally youll need to calculate the amount youll need to pay on Capital Gains Taxes and income tax based on your tax bracket. We offer full support in US UK Canada. You pay no CGT on the first 12300 that you make.

The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. See the full HMRC guidance here. Capital gains tax report.

Capital gains tax CGT breakdown. Add the remaining amount to your taxable income. We help you generate IRS compliant tax reports while maximizing your refund.

Include your cryptocurrency taxes on your tax return. Purchase 1 bitcoin BTC for 100 and then sell it for 10000. For individuals income tax supersedes capital gains tax and applies to profits.

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

![]()

Cointracking Crypto Tax Calculator

Uk Defi Tax On Loans Mining Staking Koinly

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Capital Gains Tax Calculator Ey Us

Calculating Crypto Taxes In Uk W Share Pooling Koinly

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Calculate Your Crypto Taxes With Ease Koinly

![]()

Cointracking Crypto Tax Calculator

Best Bitcoin Tax Calculator In The Uk 2021

5 Best Crypto Tax Software Accounting Calculators 2022

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021